Irs Schedule D 2025 Capital Losses

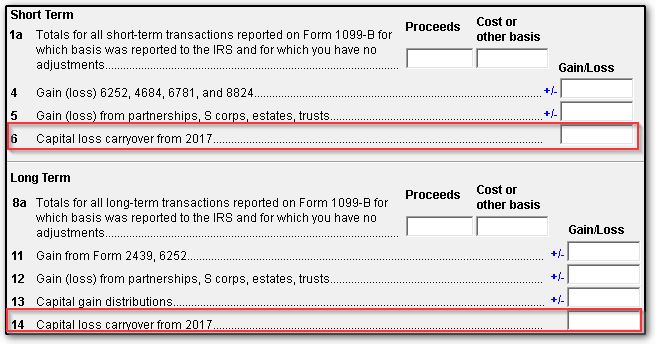

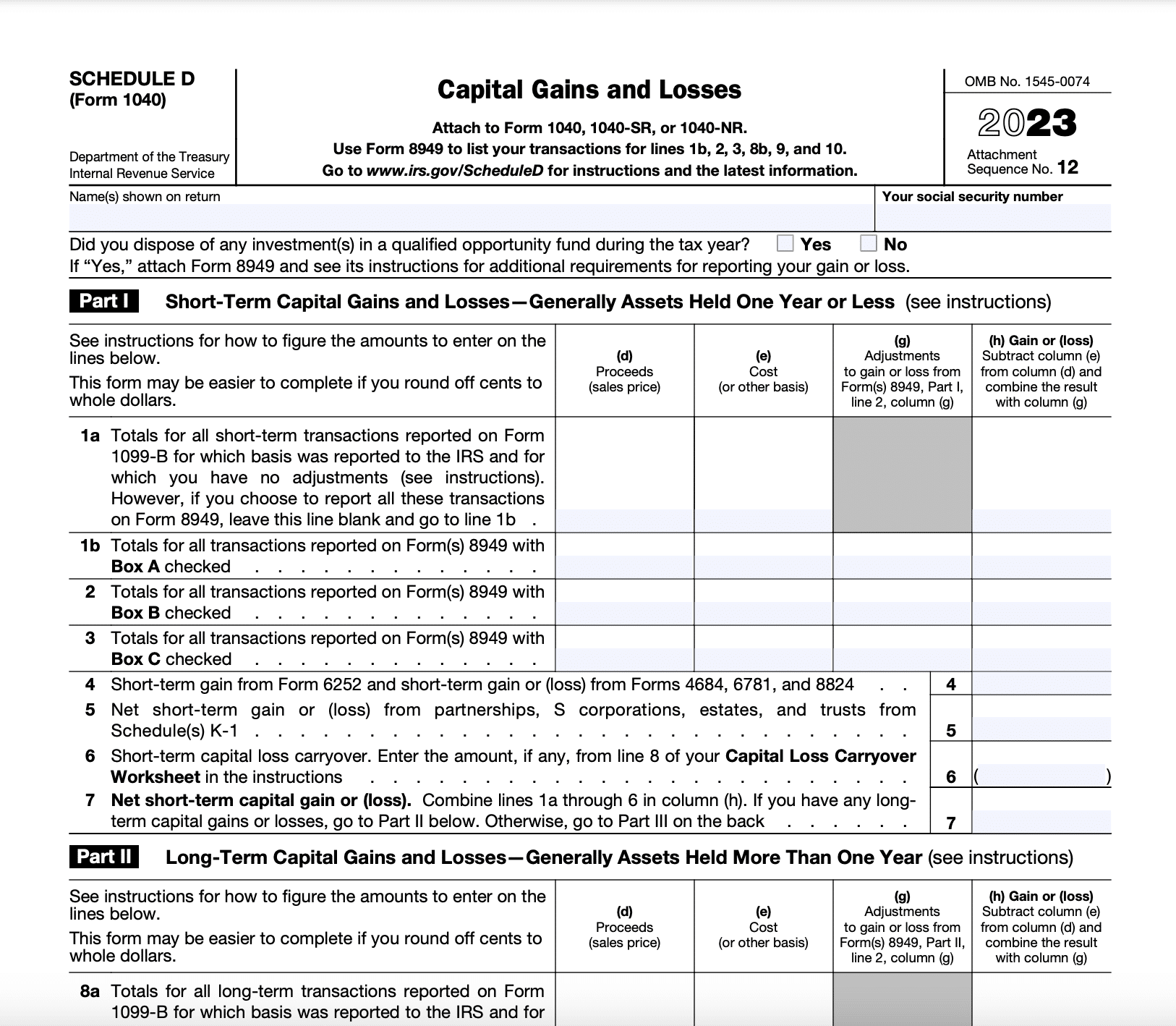

BlogIrs Schedule D 2025 Capital Losses – That won’t lower your tax bill now, but it can help you build your savings. All that said, you can also begin planning for 2025. Though you can and then calculate your capital gain or loss, . Capital gains taxes are the taxes you pay on any profits you make from selling investments, like stocks, bonds, properties, cars, or businesses. The tax isn’t applied for owning these assets — it only .

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

Irs Schedule D 2025 Capital Losses When Is Schedule D (Form 1040) Required?: Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . The 2025 tax-filing season kicked off on Jan. 29, and along with it, free resources NJ residents can access to help them complete their forms. .