Irs Single Life Expectancy Table 2025 Inherited Ira

BlogIrs Single Life Expectancy Table 2025 Inherited Ira. Inherited ira rules & secure act 2.0 changes. Use empower's retirement planner to calculate how much you would need.

Withdraw an rmd from the account based on the longer of the beneficiary’s age or the age of the original owner in.

Muriel’s first annual rmd from the inherited ira will occur during 2025, at which time muriel will be age 63.

Because secure 1.0 creates a thicket of rules and classifications to wade through, the irs decided to waive missed rmd penalties for inherited iras from 2025.

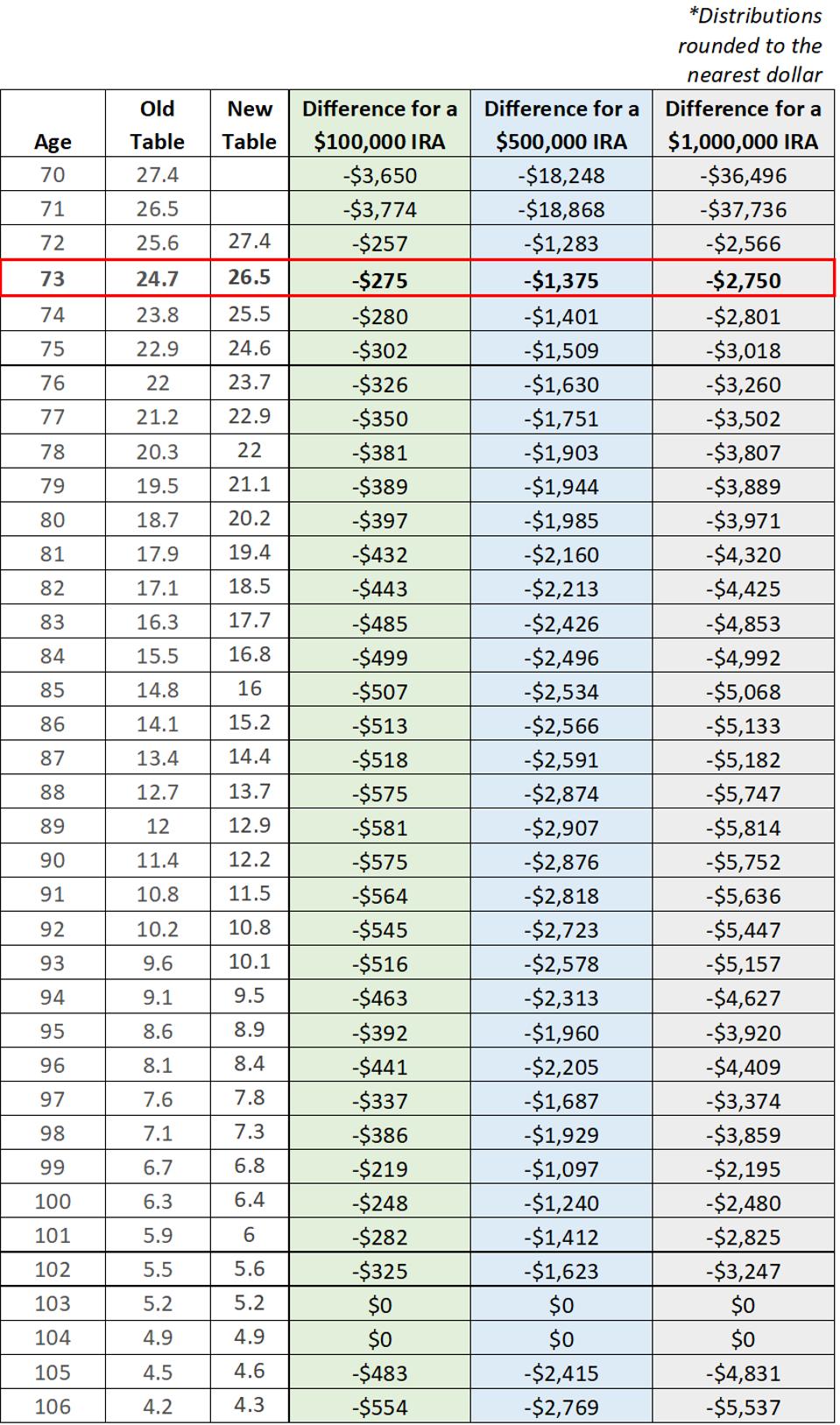

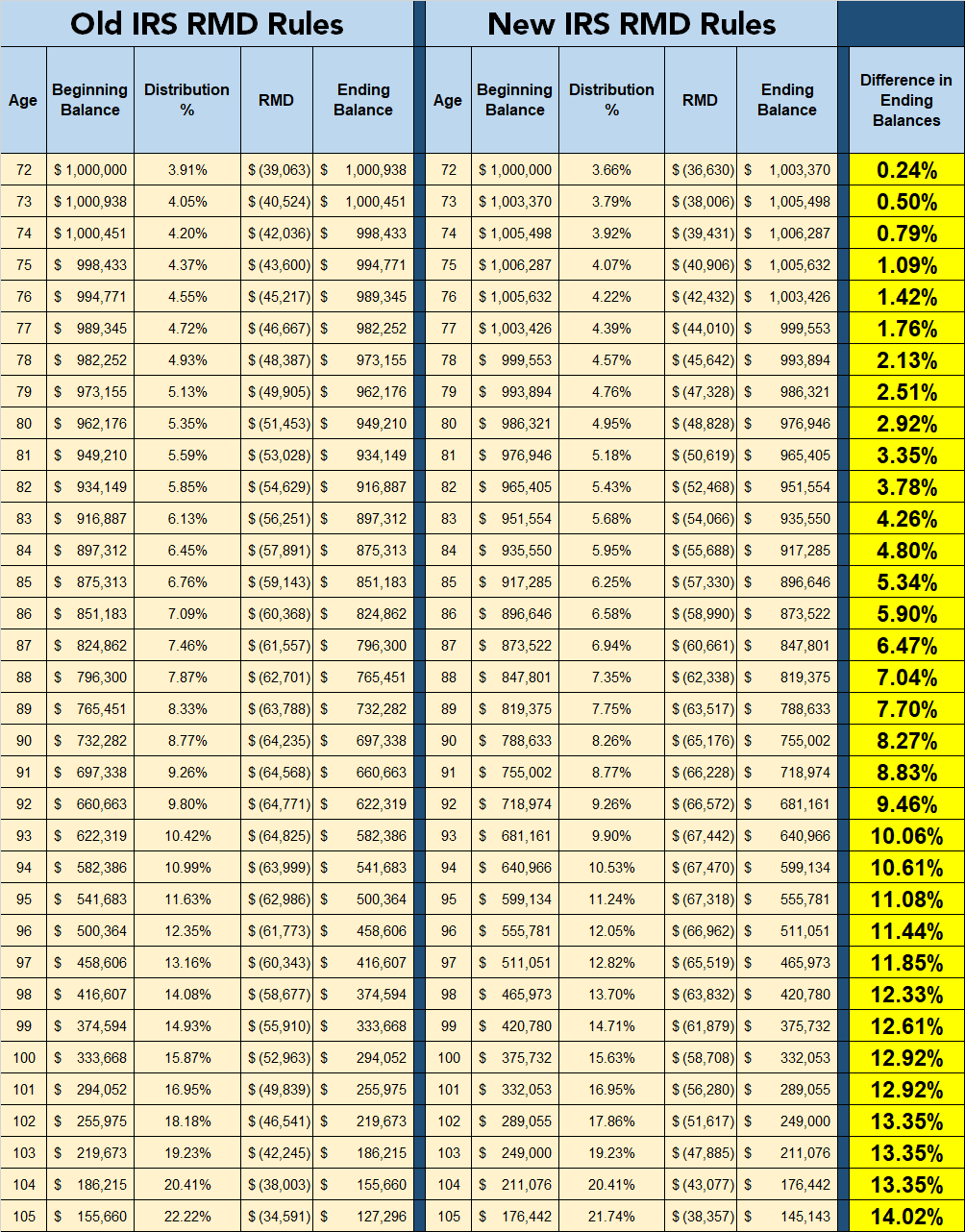

What Do The New IRS Life Expectancy Tables Mean To You?, Page last reviewed or updated: Locate your age on the irs single life expectancy table.

Irs Life Expectancy Table Ira Distributions Tutorial Pics, When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased. That factor is reduced by one for each.

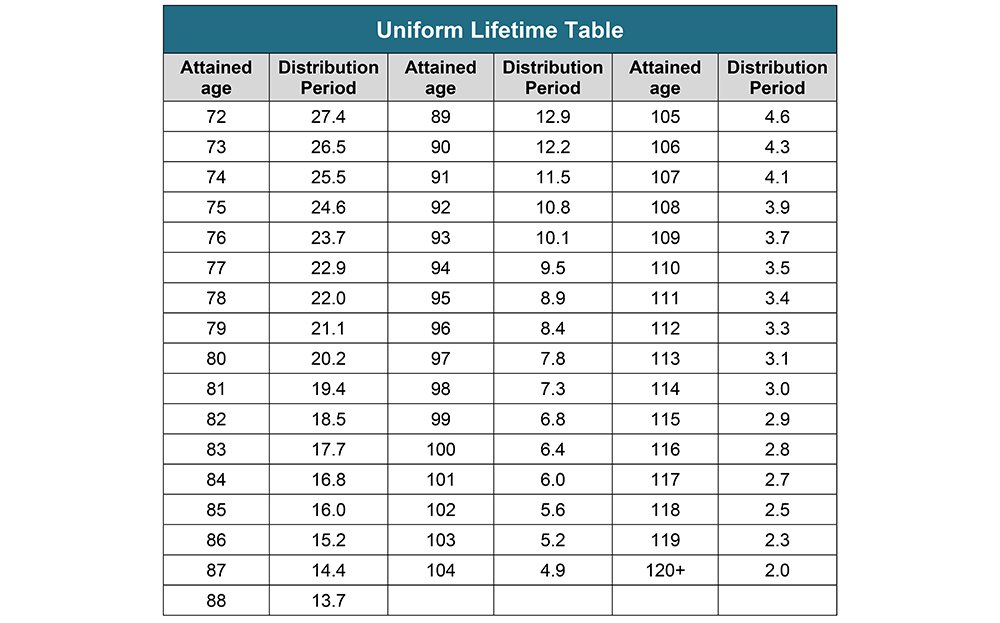

Irs Life Expectancy Table Ira Distributions Tutor Suhu, Page last reviewed or updated: Uniform lifetime table age of ira owner or plan participant life expectancy (in years) life expectancy (in years) 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87.

Irs Life Expectancy Table Ira Distributions Tutor Suhu, Want to plan your retirement? This table sets forth the life expectancy of an individual at each age.

Ed Slott's Uniform Lifetime & Single Life Expectancy Tables (for, You can find it in. It's important to understand the updated inherited ira distribution rules tied to the recent.

Irs Life Expectancy Table Ira Distributions Tutorial Pics, Page last reviewed or updated: Move your late spouse’s ira to an inherited ira in your name.

Single Life Expectancy Table Used to Calculate RMDs for Inherited, Beneficiaries use this single life expectancy table based on their age in the year after the ira owner's death. Inherited ira rules & secure act 2.0 changes.

Inherited IRA RMD Calculator to Maximize Your Inheritance (2025), Muriel’s first annual rmd from the inherited ira will occur during 2025, at which time muriel will be age 63. Withdraw an rmd from the account based on the longer of the beneficiary’s age or the age of the original owner in.

Required Minimum Distribution Table For Inherited Ira Elcho Table, The rmd table, shown above, lists the minimum required distribution for your age. It is calculated by dividing an.

Rmd Tables For Inherited Ira Elcho Table, For 2025, the ira contribution limit is $7,000. When a spouse maintains the ira as an inherited ira, he or she must use the single life table to calculate the rmd based on his or her own or their deceased.